News

Understanding the Latest Tariff Updates: Does It Impact Your Imports from China?

As businesses navigate the complexities of international trade, understanding tariff updates is crucial, especially for companies involved in importing goods from China. Recent changes to U.S. tariffs can significantly affect your bottom line, influencing sourcing strategies, pricing, and overall competitiveness. In this article, we will explore the latest tariff developments and their implications for businesses, particularly in the context of importing customized bags and gifts.

The Current Tariff Landscape

As of 2025, the U.S. has implemented several key updates to its tariff structure that impact imports from China. These adjustments are part of a broader effort to reshape trade relationships and address economic concerns. For businesses that rely on importing products, such as customized bags and gifts, understanding these changes is essential.

Key Tariff Updates

Reinstated Tariffs on Apparel and Accessories: Tariffs on various textile products, including bags and accessories, have seen reinstatements following the expiration of previous exclusions. This means higher costs for businesses importing these items from China.

Increased Scrutiny on Compliance: U.S. Customs has ramped up documentation requirements for imports, particularly for goods sourced from China. This includes stricter verification processes for the origin of materials, which can lead to delays and additional administrative burdens.

Sustainability Incentives: Tariffs are being adjusted to favor sustainably sourced materials. Companies that can demonstrate environmentally friendly practices in their sourcing may benefit from lower tariffs, encouraging a shift toward greener supply chains.

Sector-Specific Tariffs: Certain categories, such as high-emission textiles, are now subject to pilot tariffs based on their carbon intensity. This could impact how businesses approach sourcing materials and designing products.

The Impact on Your Business

For companies engaged in importing customized bags and gifts, these tariff updates necessitate a reassessment of sourcing strategies. Here are some key considerations:

1. Cost Management

With increased tariffs on a variety of products, businesses must evaluate how these changes affect their overall costs. Higher landed costs can squeeze profit margins, especially for companies that offer customizable products with lower minimum order quantities (MOQs). It's essential to revisit pricing strategies and consider how to absorb or pass on these costs to consumers.

2. Sourcing Flexibility

While China remains a significant source for many businesses, the recent tariff changes may encourage companies to diversify their sourcing strategies. Exploring alternative manufacturing locations can help mitigate the impact of tariffs. Countries like Vietnam, India, and Mexico are emerging as viable options for sourcing customized bags and gifts, often with competitive pricing and favorable trade agreements.

3. Streamlined Compliance Processes

Navigating the increased compliance requirements is crucial for maintaining smooth operations. Companies should invest in robust compliance systems to ensure that all documentation is accurate and up to date. This includes understanding the new HS codes and tariff classifications that apply to their products. Working with experienced customs brokers can help ease this transition.

4. Emphasizing Sustainability

As tariffs increasingly favor sustainable practices, businesses have an opportunity to align their sourcing strategies with environmental goals. By sourcing materials that meet sustainability criteria, companies can not only reduce their tariff burden but also appeal to a growing consumer base that prioritizes eco-friendly products. This can be particularly effective for customized products, where consumers appreciate the value of sustainable choices.

Strategic Opportunities

In light of the tariff changes, businesses that import customized bags and gifts can leverage several strategic opportunities:

1. Market Positioning

With the right approach, companies can position themselves as leaders in the market by emphasizing the quality and customization of their products. Highlighting unique designs and sustainable practices can attract attention and differentiate your brand in a competitive landscape.

2. Enhanced Supplier Relationships

Building strong relationships with suppliers in China can lead to better negotiation outcomes regarding pricing and compliance. When suppliers understand the complexities of the U.S. tariff system, they can offer solutions that minimize costs and improve efficiency in the supply chain.

3. Consumer Education

Educating consumers about the reasons behind pricing changes due to tariffs can foster understanding and loyalty. Transparent communication regarding sourcing practices and the impact of tariffs on product pricing can enhance brand trust.

4. Adapting to Trends

Staying ahead of market trends is critical. Companies should continuously monitor changes in consumer preferences, especially in the realm of sustainability and customization. Being adaptable and responsive to these trends can help businesses remain competitive.

Conclusion

The latest tariff updates represent both challenges and opportunities for businesses involved in importing goods from China. For companies specializing in customized bags and gifts, understanding the implications of these changes is essential for strategic planning and operational success. By focusing on cost management, compliance, and sustainable practices, businesses can navigate the evolving trade landscape effectively.

As you reassess your sourcing strategies and operational practices, consider how these tariff changes can shape your approach to importing. With the right strategies in place, your business can not only withstand the challenges of the current tariff environment but also thrive in an increasingly competitive market. Embrace the opportunities that arise from these changes, and position your brand for success in the years to come.

RELATED NEWS

- How to Choose a Reliable Custom Bag Manufacturer | SIYA Bags 2026-01-01

- Case Study: Custom Gym Bags for a European Fitness Brand 2025-10-23

- Backpack Sizes—Choosing the Right Fit for You 2025-10-09

- Customizing Backpacks: Essential Techniques for Distinctive Branding Solutions 2025-07-09

- What Are the Key Features of an Ideal Carry-On Backpack? 2025-05-30

CATEGORIES

LATEST NEWS

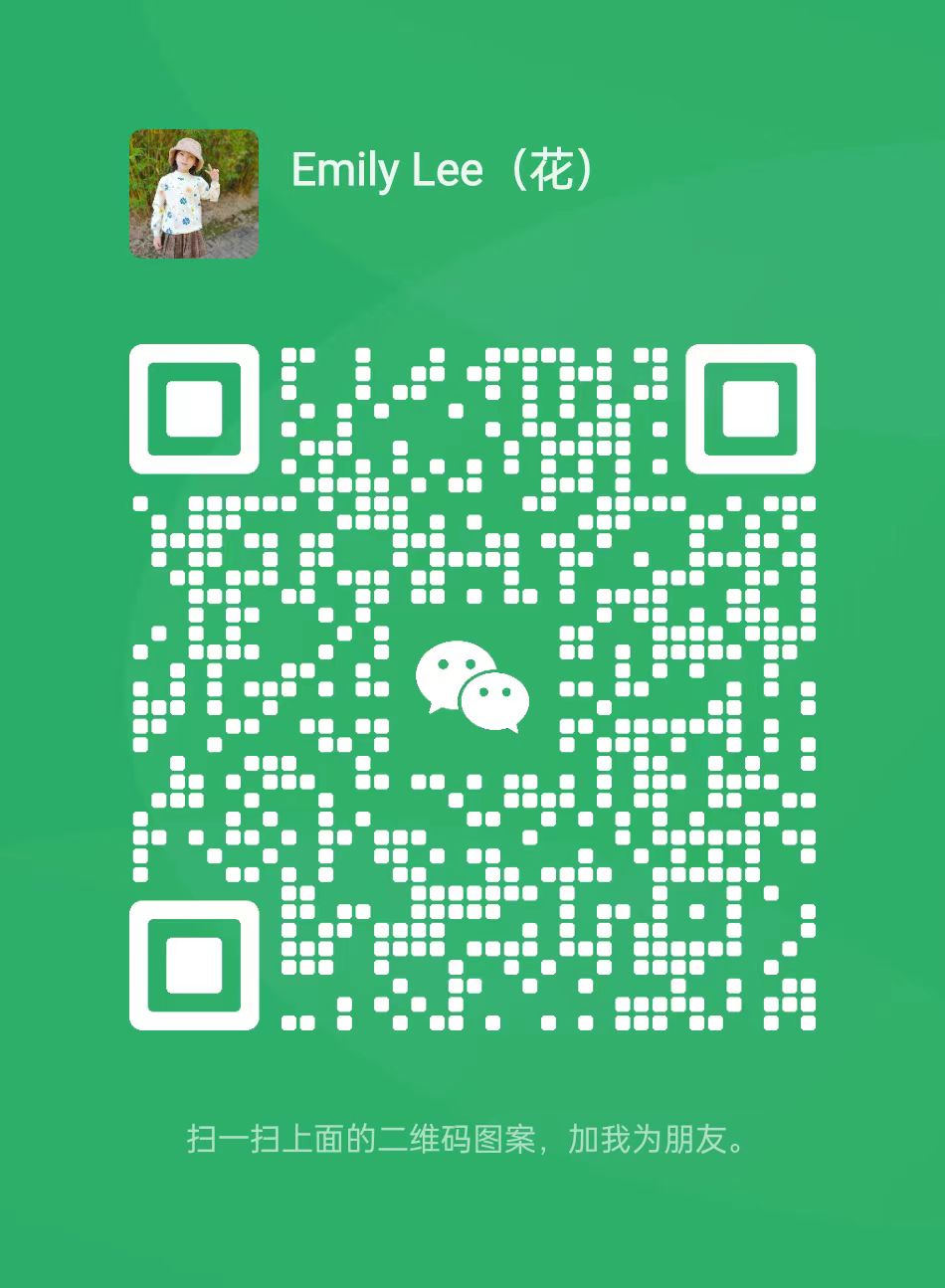

CONTACT US

Contact: Ms. Emily

Phone: +86 15243698623

E-mail: office@siyagifts.com

Whatsapp:+86 15243698623

Add: Shijie town, Dongguan city, Guangdong province, China